When a doctor prescribes a biosimilar instead of the original biologic drug, the billing process isn’t as simple as swapping one pill for another. Unlike generic drugs, which are chemically identical to their brand-name counterparts, biosimilars are highly similar but not exact copies of complex biological products. This difference changes everything - from how they’re coded in medical records to how much Medicare pays providers. Understanding how reimbursement works for biosimilars isn’t just for billing staff. It affects patient access, provider decisions, and even drug pricing across the entire healthcare system.

How Biosimilars Got Their Own Codes

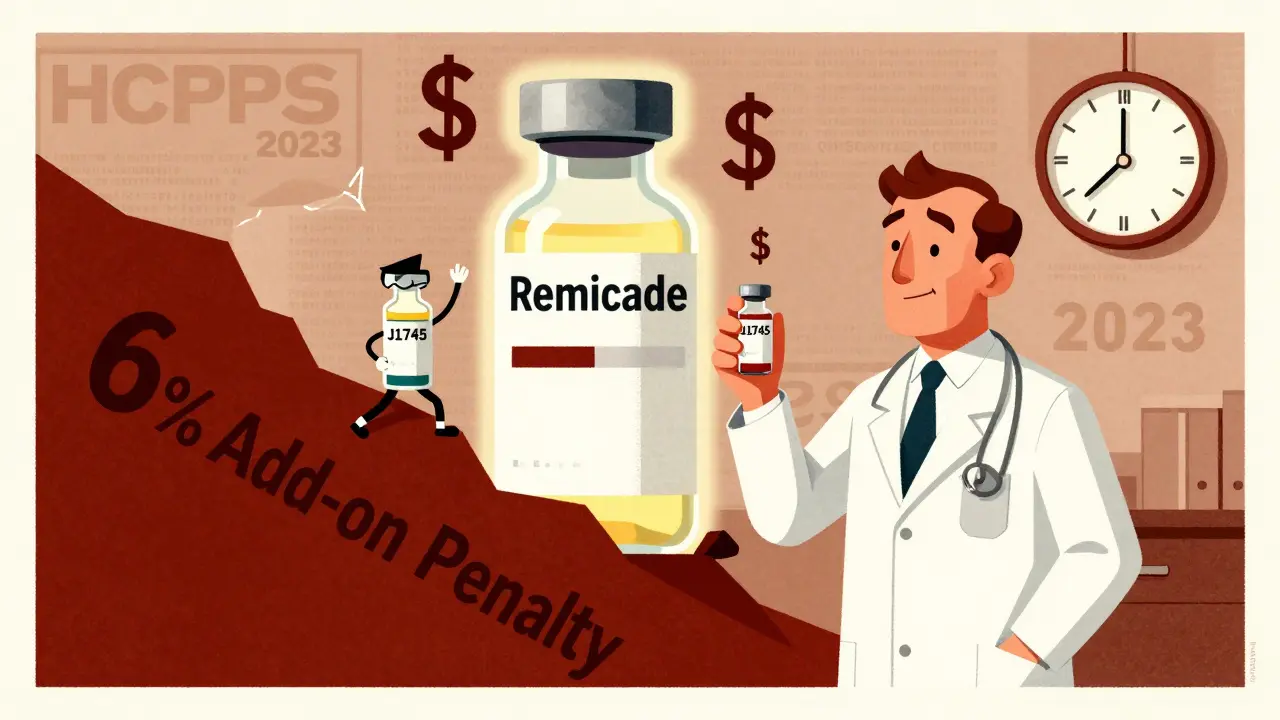

Before 2018, all biosimilars for the same reference drug shared one HCPCS code. For example, if two biosimilars were approved for infliximab (the same drug as Remicade), they both used code Q5101. CMS paid providers based on a blended average of all those drugs’ prices. That created a big problem: if one biosimilar came in cheaper, the provider still got paid the same amount as if they used the more expensive one. There was no financial reward for choosing the lower-cost option. Manufacturers had little incentive to enter the market because their lower price didn’t translate into higher reimbursement. In January 2018, CMS changed the rules. Now, every FDA-approved biosimilar gets its own unique HCPCS code - either a temporary Q-code or a permanent J-code. Inflectra for infliximab got J1745. Renflexis got J1746. Each has its own payment rate. This shift was designed to make reimbursement fairer and more transparent. It also gave manufacturers a clear path to compete on price without being penalized by a blended payment system.How Much Do Providers Get Paid?

The payment formula is straightforward but has a twist. For every biosimilar administered, Medicare Part B pays 100% of the biosimilar’s Average Selling Price (ASP) plus 6% of the reference product’s ASP. So if the reference drug (like Remicade) sells for $2,500 per dose and the biosimilar (like Inflectra) sells for $2,000, here’s the math:- 100% of Inflectra’s ASP: $2,000

- 6% of Remicade’s ASP: $150

- Total reimbursement: $2,150

The JZ Modifier: A New Layer of Complexity

On July 1, 2023, CMS added another requirement: the JZ modifier. This code must be added to claims for infliximab and its biosimilars when no drug is discarded during administration. In other words, if a vial contains 100 mg and the patient only needs 50 mg, and the provider discards the leftover 50 mg, they don’t use JZ. But if they use every last drop - maybe by splitting doses between two patients - they must report JZ. This sounds like a small paperwork tweak. But in practice, it’s become a major headache. A 2023 survey of gastroenterology practices found a 30% increase in billing staff time spent verifying discarded amounts. One clinic reported needing to track vial usage down to the milligram and log each patient’s dose separately. Without the JZ modifier, claims get denied. It’s not about money - it’s about compliance. And for small practices without dedicated billing teams, it’s a burden.

Why Biosimilar Adoption Is Still Slow in the U.S.

The U.S. biosimilar market reached $12.3 billion in 2022, but that’s only 18% of the total biologics market. In Europe, biosimilars make up 75-85% of the market for the same drugs. Why the gap? One reason is reimbursement. European countries often use reference pricing - meaning they set a single payment cap for all drugs in a class. If a biosimilar is cheaper, the provider keeps the difference as profit. In the U.S., the 6% add-on on the reference product’s ASP eats up most of that savings. A 2023 Avalere Health analysis estimated that removing the reference product’s ASP from the biosimilar’s reimbursement formula could boost adoption by 15-20 percentage points. Another issue is confusion. When the switch to individual HCPCS codes happened in 2018, 68% of cancer centers reported billing errors. Some used the old code. Others mixed up J-codes. Claim denials spiked. Even now, 22% of initial rejections are due to outdated or incorrect codes. CMS updates payment rates quarterly, but not every practice checks the latest files. Fresenius Kabi, a major biosimilar maker, found that providers who used their official coding guides reduced billing errors from 15% to under 3%.What’s Next for Biosimilar Billing?

There are signs the system is changing. In February 2023, CMS released a proposed rule asking for feedback on alternatives to the current 6% add-on. One idea: switch to a flat-dollar add-on - say, $100 per dose - regardless of the reference product’s price. Another: eliminate the reference product’s ASP entirely from biosimilar reimbursement. That would mean biosimilars get paid 100% of their own ASP plus 6% of their own ASP - making the financial incentive clearer. MedPAC, the Medicare advisory group, also recommended in June 2023 that CMS create a “least costly alternative” payment model. For drugs with three or more biosimilars on the market, Medicare would pay 106% of the volume-weighted average price across all of them. That would reward providers for choosing the cheapest option - not just the one with the highest ASP. If these changes happen, adoption could jump. RAND Corporation estimates that without structural reform, U.S. biosimilar use will plateau around 40-45%. With reform, it could hit 65-70% by 2030 - closer to European levels.

What Providers Need to Do Today

If you’re a provider, here’s what you need to do right now:- Verify the correct HCPCS code for each biosimilar you use. Check CMS’s quarterly Drug Pricing File - don’t rely on old notes.

- For infliximab and its biosimilars, always check if you need the JZ modifier. Track vial usage and discard amounts carefully.

- Train your billing team. A 2022 study showed practices that did 40-60 hours of staff training during the 2018 transition saw a 70% drop in claim denials.

- Use manufacturer guides. Fresenius Kabi, Sandoz, and Amgen all publish free coding and billing handbooks. One survey found 87% of providers rated them “helpful.”

- Monitor patient cost-sharing. Medicare Advantage plans sometimes have different copays for biosimilars. Make sure patients know what they’ll pay.

14 Comments

Carolyn Whitehead-30 January 2026

Wow this is actually way more complicated than I thought. I just assumed biosimilars were like generics but turns out the system is rigged against savings. Kinda wild that providers make more money using the expensive drug.

Hope they fix this soon.

Beth Beltway-30 January 2026

This is exactly why healthcare costs are out of control. The system incentivizes waste. Why would any provider choose a cheaper drug when they get paid more to use the brand? It’s not about patient care-it’s about profit. And CMS just doubled down on the broken model.

Stop pretending this is about innovation. It’s corporate capture.

kate jones-31 January 2026

The 6% add-on on the reference product’s ASP is a structural distortion that undermines market competition. Biosimilars are clinically equivalent, yet the reimbursement architecture creates a perverse incentive to favor higher-priced alternatives. This is not a technical issue-it’s a policy failure rooted in fee-for-service paradigms that reward volume over value.

Additionally, the JZ modifier, while well-intentioned, imposes disproportionate administrative burden on small practices without adequate technical support or streamlined EHR integration. CMS must harmonize coding updates with provider education timelines, not just issue them unilaterally.

Kelly Weinhold-31 January 2026

I’m so glad someone finally broke this down in plain terms. I work in a small rheum clinic and we were getting denied claims left and right after 2018. We had no idea what was going on until we found Sandoz’s coding guide-game changer.

Our billing lady cried when she realized she wasn’t crazy, the system just sucked. Training saved us. Now we’re using biosimilars for 80% of new patients and everyone’s happier-including the patients who pay less.

Let’s fix the payment, not just the paperwork.

Rob Webber- 2 February 2026

THIS IS A SCAM. They’re literally paying doctors MORE to use the expensive drug. That’s not a bug, that’s a feature for Big Pharma.

And now we have to track milligrams of discarded drug like we’re doing nuclear physics? Are you kidding me?

Someone needs to burn this system down.

Claire Wiltshire- 4 February 2026

Thank you for this comprehensive breakdown. Many providers still confuse HCPCS codes or overlook the JZ modifier, leading to claim denials that directly impact patient access.

Practices should establish a quarterly audit process aligned with CMS’s Drug Pricing File updates. Partnering with manufacturer education teams-like those from Amgen or Fresenius-is not optional; it’s essential for compliance and sustainability.

Also, patient cost-sharing varies widely across Medicare Advantage plans. Always verify formulary tiers before prescribing.

Mike Rose- 5 February 2026

man i just dont get why we cant do this easier. like why does it matter what code we use if the drug does the same thing? they just wanna make us do more work for no reason.

and why does the government care so much about the old drug’s price when we’re using the cheaper one? dumb.

Rohit Kumar- 6 February 2026

As someone from India where biosimilars are the backbone of affordable biologics access, this U.S. reimbursement model feels like a deliberate sabotage. Here, biosimilars are priced at 10-20% of originators, and providers keep the savings-so adoption is over 80%.

In the U.S., the system isn’t broken-it’s designed to protect profit margins. The 6% add-on isn’t a technical oversight; it’s a lobbying victory. You don’t fix reimbursement to help patients-you fix it when shareholders demand it.

Europe doesn’t have this problem because they treat drugs as public goods, not revenue streams. Until the U.S. stops treating healthcare like a stock market, biosimilars will remain a niche curiosity.

Adarsh Uttral- 7 February 2026

bro the jz modifier is wild. i work in a clinic and we had to hire someone just to track vial waste. one guy said he spent 4 hours a day just logging what was left in the vial. no one has time for this.

and the worst part? patients still pay the same copay whether we use the expensive or cheap drug. so we’re doing all this extra work and they don’t even save money.

what’s the point?

Yanaton Whittaker- 9 February 2026

Why are we letting foreign drug companies dictate our healthcare system? The U.S. invented biologics. We should be rewarding American innovation, not subsidizing cheap knockoffs from India and Europe.

This whole biosimilar thing is just a globalist plot to weaken American pharma. The 6% add-on? That’s protecting our sovereignty.

Stop giving money to foreign labs and start paying American doctors to use American drugs.

Kathleen Riley-10 February 2026

One cannot help but observe the ontological dissonance inherent in the current reimbursement paradigm: the epistemological framework of biosimilar equivalence is in direct contradiction with the axiomatic structure of differential reimbursement. The state, through CMS, enforces a semantic equivalence in clinical outcomes while instituting a fiscal hierarchy that privileges originator products. This is not merely policy-it is ideological.

Beth Cooper-11 February 2026

Did you know the JZ modifier was secretly pushed by Big Pharma to create more paperwork so small clinics give up and go back to the expensive drug?

They don’t want you to split vials. They don’t want you to save money. This is all part of the plan to keep prices high.

And the ‘6% add-on’? That’s not a payment-it’s a bribe. The same people who made Remicade are the ones writing the rules.

Wake up. This is not healthcare. It’s a corporate surveillance state disguised as medicine.

Shubham Dixit-13 February 2026

Let me tell you something-India produces 70% of the world’s biosimilars and we do it without this ridiculous bureaucracy. Our doctors get paid a flat fee per procedure, and the drug cost is irrelevant. Patients get cheaper medicine, providers aren’t penalized, and the system works. Why can’t the U.S. just copy this? Because American hospitals are owned by hedge funds and insurance CEOs who make more money when you’re sick.

They don’t want efficiency. They want dependency. The JZ modifier? A distraction. The 6% add-on? A tax on common sense. And you think this is about science? No. It’s about profit. Always profit.

KATHRYN JOHNSON-14 February 2026

The current reimbursement structure is indefensible. The 6% add-on on the reference product’s ASP is a regressive subsidy that penalizes cost-conscious providers and rewards inefficiency. The JZ modifier, while administratively burdensome, is a necessary compliance mechanism for accurate cost tracking. However, the absence of standardized EHR integration and real-time coding validation tools renders compliance punitive rather than protective. CMS must prioritize interoperable infrastructure over bureaucratic add-ons. Patient outcomes are not served by administrative complexity.